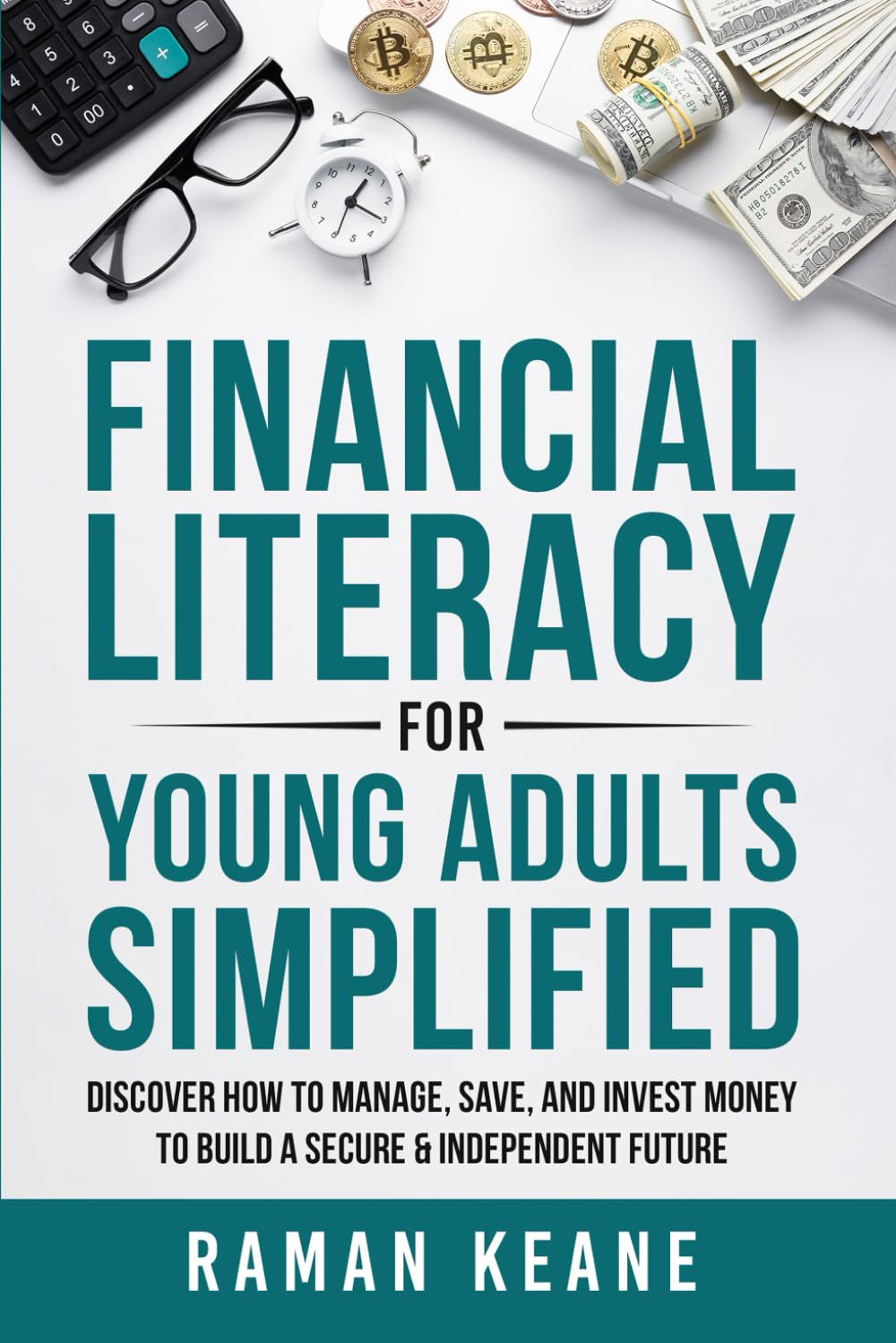

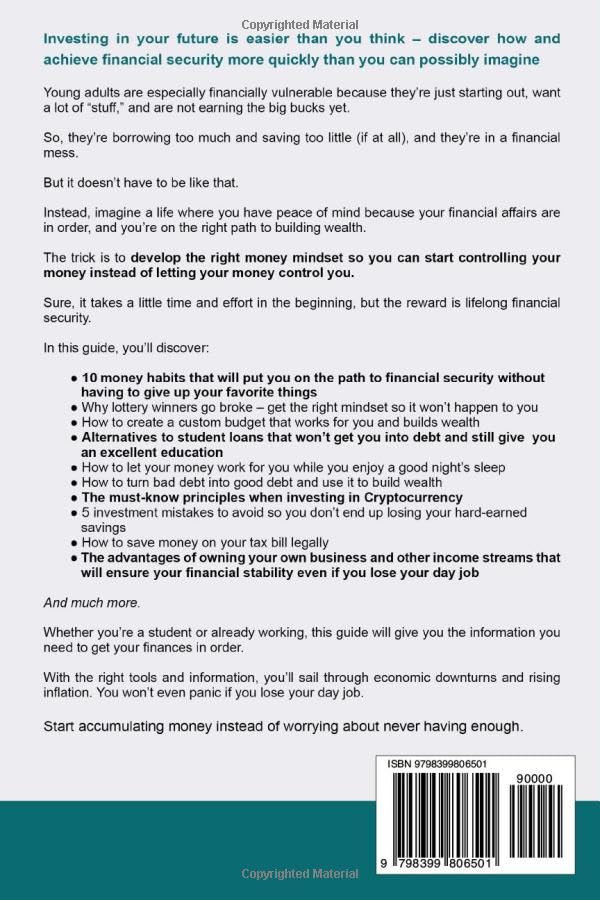

Financial Literacy for Young Adults Simplified: Discover How to Manage, Save, and Invest Money to Build a Secure & Independent Future

$65.00

Achieving financial security is a journey that requires intentional planning and disciplined habits. Here are some strategies to help you build a solid financial foundation:

1. Establish a Budget and Track Expenses

Creating a budget allows you to monitor your income and expenditures, ensuring you live within your means. Regularly tracking your spending helps identify areas where you can cut back and save more.

2. Build an Emergency Fund

Setting aside funds for unexpected expenses provides financial stability and peace of mind. Aim to save at least three to six months’ worth of living expenses.

3. Automate Savings and Investments

Automating your savings ensures consistent contributions to your financial goals. Consider setting up automatic transfers to a savings account or retirement fund.

4. Diversify Your Investments

Diversification reduces risk by spreading investments across various asset classes. This strategy helps protect your portfolio from market volatility.

5. Avoid Common Investment Mistakes

Be aware of pitfalls such as overconcentration in individual stocks, emotional decision-making, and neglecting to rebalance your portfolio. Educate yourself to make informed investment choices.

6. Manage Debt Wisely

Prioritize paying off high-interest debts and avoid accumulating new debt. Develop a plan to manage and reduce existing debts to improve your financial health.

7. Plan for Retirement Early

Starting retirement planning early allows your investments to grow over time. Contribute to retirement accounts like a 401(k) or IRA to benefit from compound interest.

8. Continuously Educate Yourself

Stay informed about personal finance and investment strategies. Regularly reviewing your financial situation and adjusting your plans as needed is crucial for long-term success.

By implementing these practices, you can work towards achieving financial security and building wealth over time.

Be the first to review “Financial Literacy for Young Adults Simplified: Discover How to Manage, Save, and Invest Money to Build a Secure & Independent Future” Cancel reply

Related products

Financial Thinking Book

Magic of Thinking Success: Your Personal Guide to Financial Independence

Financial Thinking Book

My Money Journey: How 30 people found financial freedom – and you can too

Financial Thinking Book

Financial Development: A journey from financial struggle to financial freedom

Financial Thinking Book

Reviews

There are no reviews yet.